Card Security

We're here to protect you from fraud.

Questions?

our fraud specialists.

With your cell number & email, we can securely protect your account.

Through text messages, emails and phone calls, we can notify you immediately if we notice a potential fraudulent transaction on your debit or credit card.

When fraudulent activity is detected:

- You'll get a text from 21556. Follow the prompts to validate the transaction.

- You'll get an email. If you don't reply by text, an email will be sent 15 minutes later.

- You'll get a call. If you don't respond by text or email, we'll give you a call.

New fraud protection feature

We've added a new layer of security to our credit and debit cards, especially useful for those who shop online and are concerned about safely making those online purchases. A one-time passcode may be sent to your mobile phone to confirm the online transaction belongs to you.

- When additional authentication is necessary to approve your online transaction, a passcode request will display on your checkout screen. Check your mobile phone for a text from 90742 containing the passcode, then enter it where prompted online.

- Please note, if you don’t enter the correct passcode, your transaction will be declined. If you have any issues, please call us at 309-793-6200 or 800-722-0333 during business hours to resolve.

- One-time passcodes will not apply to most transactions, so don’t be alarmed if you don’t receive a request. But, don’t be alarmed if you do; this extra authentication step is just a sign that our security measures are working to keep your accounts safe.

See FAQs below for more information.

Confirm your information is up-to-date

- Online. Start a secure chat with us at IHMVCU.org/Chat. We're available 7 a.m. - 7 p.m. Monday - Friday and 8 a.m. - 1 p.m. on Saturdays.

- By phone. Call us at 309-793-6200 or 800-722-0333. We're available 7 a.m. - 7 p.m. Monday - Friday and 8 a.m. - 1 p.m. on Saturdays.

- In person. We'd love to see you. Visit any of our convenient locations and we'll update your information on the spot.

FREQUENTLY ASKED QUESTIONS

- What should I do when I receive a text message or email about a potential fraudulent transaction on my IHMVCU debit card or credit card?

If you receive a text message alert or email, first double-check your recent transactions via online banking or the mobile app. If the transaction listed was not authorized by you or is unfamiliar, respond Y to the text message Is this fraud? or click the All transactions authorized button in the email.

- Will I be charged for fraud alerts?

No. Fraud alert text messages are free. Wireless carrier text fees are not applicable when receiving or sending fraud alerts. - Should I respond to a fraud alert?

Yes. By responding quickly, we can ensure your account is secure. Fraud alert messages will never ask for personal information or account number. If you receive a fraud alert requesting personal information, assume it's suspicious and give us a call at 309-793-6200 or 800-722-0333. - Can I opt-out of receiving fraud alert messages by text?

Yes. If you wish to opt-out of Fraud Text Alerts, you can reply STOP to any text alert you've received within 30 days. You'll still receive email and phone call alerts.

- What happens if there's a suspicious transaction on my card?

You'll receive a fraud alert via text message, email, and by phone.

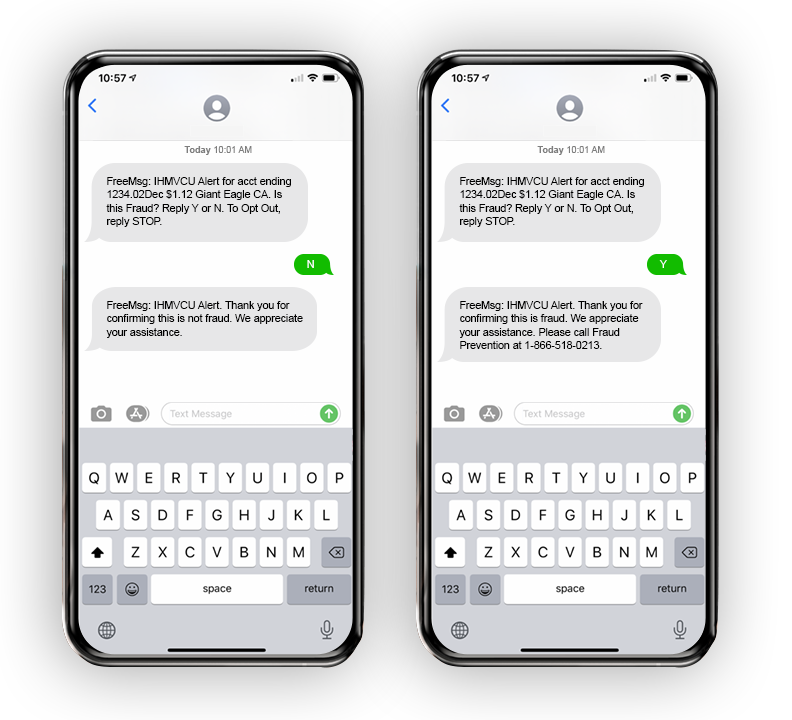

Alert by text message

The text message will read: FreeMsg: IHMVCU Alert for acct ending in 12345.02Dec $1.12 Giant Eagle CA. Is this Fraud? Reply Y or N. To Opt Out, reply STOP.

If you respond N. FreeMsg: IHMVCU Alert. Thank you for confirming this is not fraud. We appreciate your assistance.

If you respond Y. FreeMsg: IHMVCU Alert. Thank you for confirming this is fraud. We appreciate your assistance. Please call Fraud Prevention at 1-866-518-0213.

Alert by email

The email will list one or more transactions that need to be verified. You'll be asked to click the button that best represents the transactions listed: No Fraud: All transaction(s) authorized OR Fraud: One or more transaction(s)s NOT authorized.

If you respond No Fraud: All transactions authorized. You'll receive the following reply: Thank you for confirming this is not fraud. We appreciate your assistance.

If you respond Fraud: One or more transactions are NOT authorized. You'll receive the following reply: Thank you for confirming this is fraud. We appreciate your assistance. Please call Fraud Prevention at 1-866-518-0213.

What is a one-time passcode?

This feature requires you to receive a one-time passcode for certain card-not-present transactions (online transactions) that have exhibited heightened risk. This passcode helps verify a your identity at the point of purchase.What if I accidentally exit in the middle of inputting my one-time passcode?

You will receive a failed authentication and be instructed to contact the credit union.

What if I don't receive a one-time passcode for a purchase that says it's required for?

Please contact us at 309-793-6200 or 800-722-0333. We’ll verify your mobile number data on file.What should I do if I my one-time passcode authentication failed?

If you receive a failed authentication, please contact us at 309-793-6200 or 800-722-0333 for assistance. Once we confirm your identity, we can set the card number into bypass and allow you to attempt the authentication again.

Quick reminders for IHMVCU members

IHMVCU is committed to helping you protect yourself from identity theft and fraud. We would like to remind members:

- We will never call requesting account information including Online Branch username and password.

- We will never send you an email or text message requesting verification of account information Online Branch username and password.

- Your caller ID may show IHMVCU’s real phone number, but criminals can easily disguise this to show any ID and phone number they desire.

- If you receive a call you believe may be genuine, you should not ignore the possibility that there may be fraudulent activity on your account. Ask the caller for specific details, hang up and call us at 309-793-6200 or 800-722-0333 to verify.

- We have your account information on file. If you contact us, we’ll verify your ID with specific information.

What to do if you fall victim to a scam?

- Call IHMVCU at 309-793-6200 or 800-722-0333. We’ll assist you in protecting your IHMVCU accounts.

- If you use Online Branch, log in immediately and change your password.

- Contact your local police department or law enforcement agency and inquire about filing a report.

- If you’ve disclosed sensitive or personal information, we recommend you contact one of the three major credit bureaus and inquire about placing a fraud alert on your file. This'll prevent criminals from opening accounts and using your information. Below are the phone numbers for the fraud divisions at each bureau:

Experian: 888-397-3742

TransUnion: 800-680-7289

Equifax: 800-525-6285