Money Smarts Blog

A Kid Will Cost Me How Much?

Feb 13, 2023 || Kristen Anderson, Digital Strategist

I don’t know about you, but it seems like EVERYONE is having babies right now. Every time I pull up my Facebook, Instagram and even the Super Bowl… babies. Everywhere.

Disclaimer: I’m in my early 30s, so it makes sense that people around me are having babies. And they’re all super cute, so I’m absolutely not complaining. But because I’ve been seeing all of these babies, it has me me thinking … how much will my friends be spending to raise these adorable little monsters?

Now that you have the big new baby purchases out of the way and maybe have even gotten a bill or two from your hospital (ouch…), let’s talk about how much that kid of yours will cost you until they’re 18.

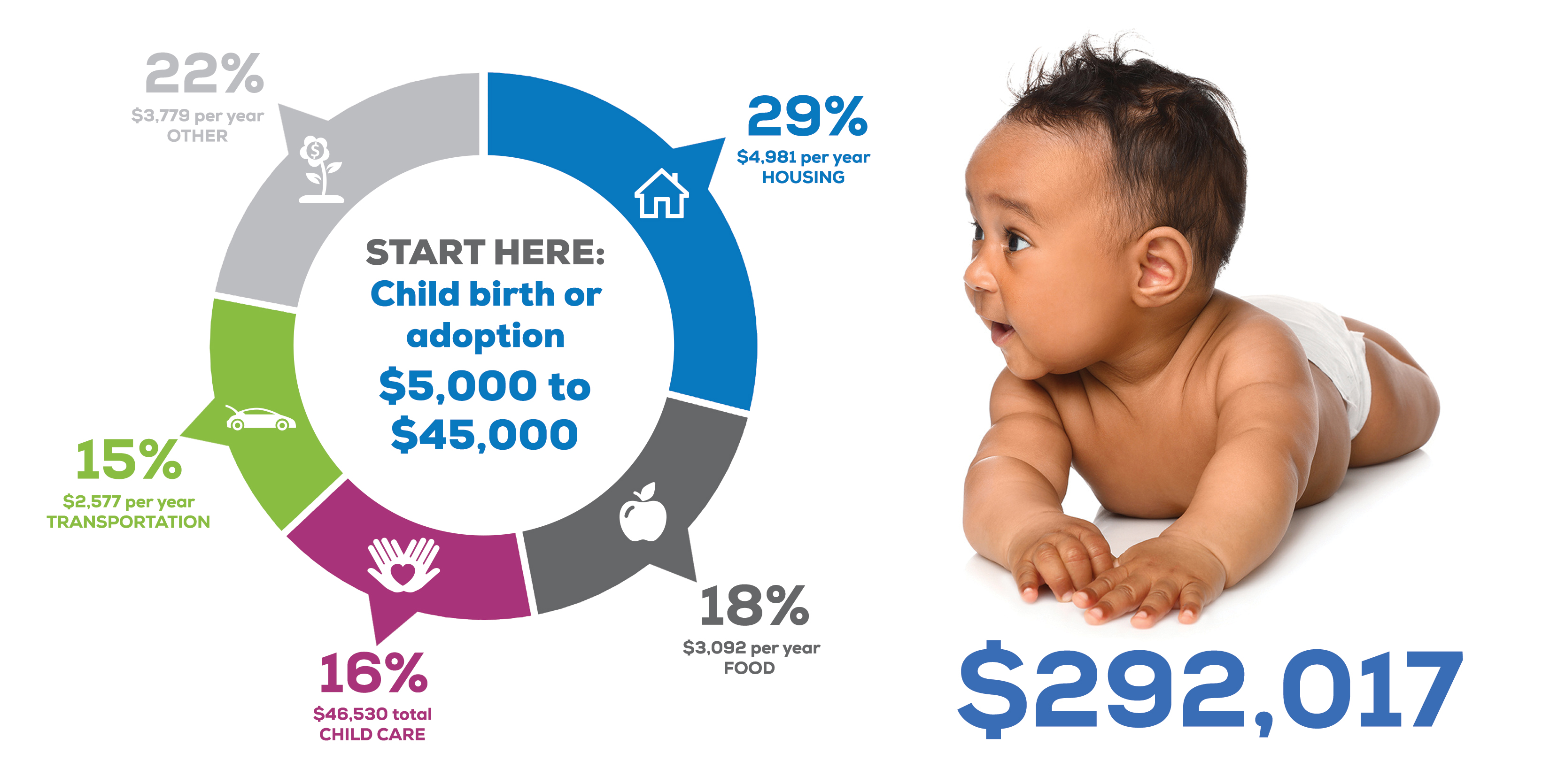

The USDA used to publish an annual report that calculated the average cost of raising a child to adulthood (not including college), but it was last published in 2017. It found that the cost of raising a child born in 2015 would cost on average $233,610, assuming the child was born to a middle-income, married couple.

In 2022, with projected inflation costs factored in, that number goes to…

$292,017

Wow, that’s a lot.

The good news: Economies of scale or saving costs with increased quantities (in this case, children)

Each additional child costs less because siblings oftentimes share a room, families usually buy food in larger quantities and we’ve all heard of hand-me-downs.

The bad news: Costs don’t include college

The average annual cost of public college for the 2022-2023 academic year comes in at $10,950 for in-state; for a private college, it's $39,400, according to College Board. These numbers do not include room and board.

That means saving early and utilizing a 529 plan or other investment vehicles to keep kids from graduating with a large amount of debt.

So now that I’ve scared you (my sincerest apologies), what do you do?

First, remember the numbers above are general averages, and that every child and family is unique. If you live in Los Angeles vs. rural Iowa or Illinois, there’s going to be a drastic difference. If you’re a lower-income family, you naturally spend less per child.

Know what’s most important to you so you allocate the appropriate funds and think about lowering costs in other areas. Do some research, ask your friends and family for money saving tips and put what makes sense for your family into action.

Lastly, and most importantly, enjoy every minute. While they cost a lot of money, the joy they bring is priceless … or so I've heard.