Money Smarts Blog

Free tax-filing resources are available to many

Jan 21, 2022 || Sara Fossey and Courtney Kay-Decker

Did you know that 70% - that’s right seventy percent - of America’s taxpayers are eligible to file their tax returns for free?

Free File Program

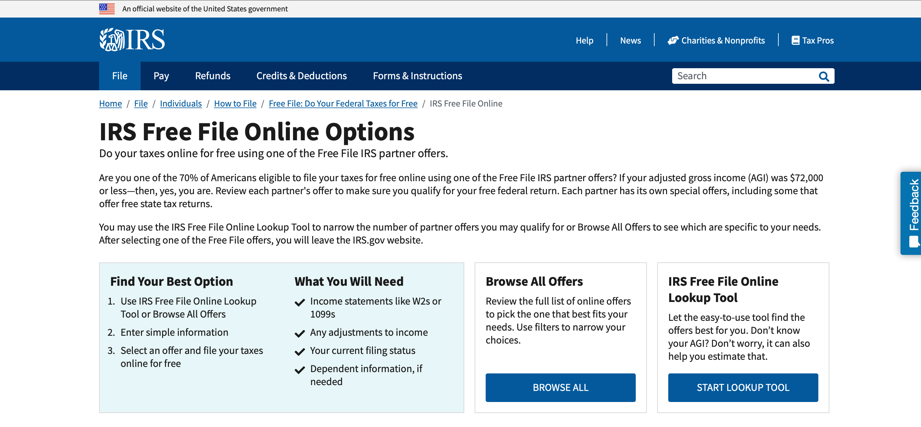

If you are comfortable using the internet and have a household gross income of $73,000 or below, you can prepare your own returns using commercial software through the FreeFile program. Through the program, eligible taxpayers can file both their federal and state income taxes for free with helpful interview-style software.

Begin by visiting irs.gov/freefile. It’s important to know that starting at the IRS website is the only way to ensure that your filing experience is completely free. You can browse the offers available, or use the IRS tool to determine which provider best suits your needs.

The tax prep software options include familiar names like Iowa’s own Tax Act, TurboTax, FileYourTaxes.com, and TaxSlayer. Follow the directions within the software you’ve chosen to complete and e-file your returns. Done!

VITA Program

If you would rather interact (safely) with a human preparer who completes your return for you, the Volunteer Income Tax Assistance (VITA) Program is for you. Locally, the Quad Cities VITA Coalition is led by United Way Quad Cities, in collaboration with AARP of Western Illinois and AARP of Eastern Iowa.

Families or individuals earning $57,000 or less are generally eligible to have an IRS-Certified VITA volunteer prepare their tax returns. Taxpayers can schedule two types of appointments: prepare-while-you wait or drop off. Prepare-while-you-wait is as it sounds – a preparer will prepare your return while you wait.

Again this year the United Way is offering a drop off service at some locations. Using this service, the taxpayers meet with a preparer for a short information-gathering meeting, usually 15-30 minutes. Approximately one week later, you'll meet with a preparer who will review your return with you (another short appointment) and electronically file your tax return. This option is great for folks who prefer to limit the duration of exposure to others or are otherwise on the go.

For either option, locations are available on both sides of the river. To schedule an appointment, call 211 or 563-355-9900. Be sure to indicate which type of appointment you prefer when scheduling.

For more information on eligibility and tax preparation locations, visit https://www.unitedwayqc.org/vita.

Note: To protect our taxpayers and volunteers, appropriate face coverings and physical distancing will be required at all VITA sites.

Tips for tax filing success (and faster refunds)

- Make sure you have all of your information returns and notices before you file. We all know to be on the lookout for W-2s and 1099s. For 2021, there are a few other documents that many taxpayers will receive:

- Parents need to be on the lookout for Letter 6419 related to the Advance Child Tax Credit. In many cases, each parent will receive one.

- Those who received the third stimulus payment (also called "EIP 3") will receive Letter 6475. With this Letter, you’ll be able to determine whether you are eligible for the pandemic-related Rebate Recovery Credit.

- Any unemployment benefits you received will be reported on Form 1099-G. As of today, unemployment benefits are taxable.

- Check last year’s return. Reviewing your prior year return is a good tool to jog your memory as to what income sources and deductions you have each year. This year, checking your 2019 is essential if you claimed the earned income tax credit (EITC). If you earned more in 2019 than 2021, you can elect to use your 2019 earned income for your 2021 EITC claim.

- Double-check your records. Credit card companies and financial institutions provide statements and annual summaries that can help spot sources of income or deductions. Up to $300 for individuals and $600 for married couples in charitable contributions are deductible regardless of whether you itemize.

- File electronically. Electronic returns require less human interaction, allowing for faster refunds than paper returns.

By following these tips, you can make the tax filing process less…. taxing.

For more filing season tips, visit the IRS website: https://www.irs.gov/individuals/steps-to-take-now-to-get-a-jump-on-next-years-taxes

About the Authors:

Sara Fossey is the VITA Manager at United Way Quad Cities. Courtney Kay-Decker is a volunteer site coordinator for the Quad Cities VITA program and practices law at Lane & Waterman, LLP. Previously, she served as the Director of Revenue for the State of Iowa.