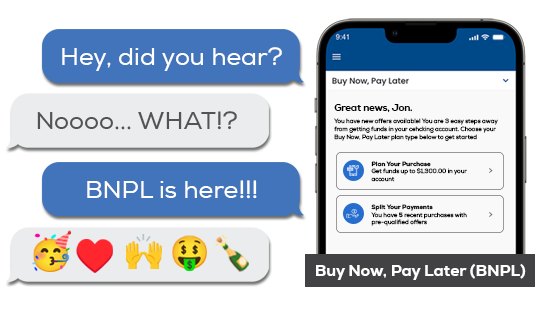

Buy Now, Pay Later (BNPL) has arrived!

Flex your budget and pay your way. Buy Now, Pay Later (BNPL)* from IHMVCU offers two types of services available to eligible members with an IHMVCU debit card. Whether you’re planning a purchase or looking to spread out payments for one you’ve already made, BNPL from IHMVCU can help manage your cash flow and stay within your budget.

- Plan Your Purchase offers are for when you need funds upfront to make a purchase and would like to pay for the loan in installments over time.

- Split Your Payments offers are available when you’ve already made eligible debit card purchases and would like to pay for those purchases in installments over time.

To see if you have BNPL offers, simply login to online banking and locate “Buy Now, Pay Later”. View and accept your available BNPL offers in seconds, and accept the repayment terms that work for you. You'll receive your funds in your account in moments.

Don't have online banking? Sign-up today.

You’re already qualified.

- No credit check.

- No application. Your BNPL offers are tailored for you and are pre-qualified. Simply view and accept to proceed.

- No new cards and accounts. Continue using your existing IHMVCU checking account and debit card when accessing BNPL offers.

- Everything in your online banking. Review and manage your BNPL offers, plans, and payments in one place.

Buy Now, Pay Later can help you split payments on things like:

Car maintenance

Travel expenses

Shopping expenses

Unexpected expenses

Common BNPL questions from our members

-

Where can I find my BNPL offers?

BNPL offers are found in IHMVCU’s online banking from the "Borrow" tab. From the mobile app, you can find "Buy Now, Pay Later" when you click the “More” tab.

-

What's the difference between Plan Your Purchase and Split Your Payment?

Plan Your Purchase loans are offered to members based on pre-qualifying factors such as amount of monthly deposits, average daily balance, and account status. Members are not required to have a debit card to receive these offers.

Split Your Purchase loans are offered AFTER a debit card purchase is posted to your account.

You may receive both types of offers if you have a debit card and meet the qualifications that factor in such things as deposits, average daily balance, account/loan status.

-

How do I know if a purchase is eligible for Buy Now, Pay Later?

When an eligible Buy Now, Pay Later purchase is made, it is automatically displayed in the Buy Now, Pay Later tab in online banking. Purchases must be a minimum of $80 and a maximum of $2,500 for Split Your Purchase offers. Purchases must be a minimum of $100 and a maximum of $2500 for Plan Your Purchase offers.

-

Why can't I see any BNPL offers?

If you don’t see any BNPL offers, this may be because your current account status or your recent debit card purchases are not eligible for BNPL. If you already have active BNPL plans, you may not be eligible for additional offers until the active plans are paid back.

If you recently received an email with offers, but don't see the offers in online banking, this could be due to the reason stated above; OR if you have multiple accounts, you may need to login directly to the account where the offers are presented. For assistance, please contact us.

-

What is an eligible purchase?

An eligible purchase is a debit card purchase made in the past 60 days that is at least $80 and was not a cash equivalent purchase (e.g., ATM withdrawal, money order, cash advance, etc.). Other restrictions surrounding the merchant type and transaction limits may affect BNPL eligibility.

-

Does BNPL require a credit check?

No, IHMVCU’s debit card BNPL offering does not require a credit check.

-

Are there any things that Buy Now, Pay Later cannot be used for?

Buy Now, Pay Later offers will not be available for loan payments (mortgage, auto, credit card, etc.), payments to third-party buy now, pay later providers, and cash transactions such as ATM withdrawals.

-

Is there a late fee if I do not pay my plan on time?

Yes, late fees will apply if the payment is not received after your grace period. The specific timing and amount of late fees can vary depending on the laws of your state. You can review your loan agreement for details. Scheduling automatic payments can help to avoid being assessed a late fee.

-

Is there a maximum number of payment plans I can have at the same time?

Yes, a member can have up to 10 active BNPL loans at any one time. This maximum is made up of a maximum of 5 Split Your Purchase loans plus 5 Plan Your Purchase loans, provided they do not exceed $2,500 or the individual's maximum qualified amount.