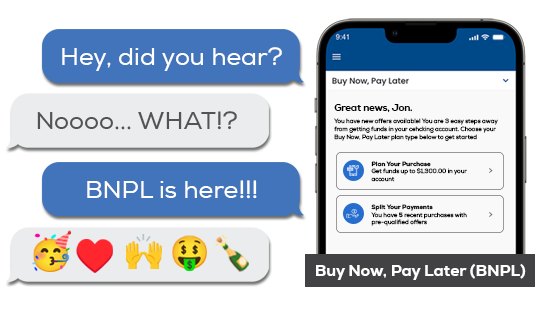

Buy Now, Pay Later (BNPL) has arrived!

Flex your budget and pay your way. Buy Now, Pay Later (BNPL)* from IHMVCU offers two types of services available to eligible members with an IHMVCU debit card. Whether you’re planning a purchase or looking to spread out payments for one you’ve already made, BNPL from IHMVCU can help manage your cash flow and stay within your budget.

- Plan Your Purchase offers are for when you need funds upfront to make a purchase and would like to pay for the loan in installments over time.

- Split Your Payments offers are available when you’ve already made eligible debit card purchases and would like to pay for those purchases in installments over time.

To see if you have BNPL offers, simply login to online banking and locate “Buy Now, Pay Later”. View and accept your available BNPL offers in seconds, and accept the repayment terms that work for you. You'll receive your funds in your account in moments.

Don't have online banking? Sign-up today.

You’re already qualified.

- No credit check.

- No application. Your BNPL offers are tailored for you and are pre-qualified. Simply view and accept to proceed.

- No new cards and accounts. Continue using your existing IHMVCU checking account and debit card when accessing BNPL offers.

- Everything in your online banking. Review and manage your BNPL offers, plans, and payments in one place.

Buy Now, Pay Later can help you split payments on things like:

Car maintenance

Travel expenses

Shopping expenses

Unexpected expenses

Common BNPL questions from our members

How do I know if a purchase is eligible for Buy Now, Pay Later?

When an eligible Buy Now, Pay Later purchase is made, it is automatically displayed in the Buy Now, Pay Later tab in online banking. Purchases must be a minimum of $80 and a maximum of $2,500 for Split Your Purchase offers. Purchases must be a minimum of $100 and a maximum of $2500 for Plan Your Purchase offers.