Money Smarts Blog

Understanding and improving your FICO score

Jul 13, 2017 || James Beiderbecke

You’ve seen the commercials: check your credit score for free, improve your FICO rating now, people wishing they had checked their credit rating before splurging, etc.

Credit scores have been a hot topic for a while now, and with good reason. According to ValuePenguin, the total outstanding U.S. Consumer debt is $3.4 trillion and 38.1% of all households carry some sort of credit card debt. Americans are borrowing more than ever now, and their credit scores are an important part of that.

First, let’s establish what exactly a “credit score” is and why you want to have a higher score.

Basically, a credit score is a number ranging from 300 – 850 that represents a person’s creditworthiness. The higher a person’s score, the more likely a financial institution will lend money to them. Essentially, a credit score depicts how trustworthy someone is with paying off their debt.

This blog will focus on FICO scores, the most well-known and easily accessible credit score. FICO is certainly not the only score available. Visit LendingTree.com for more information on the other types of credit scores.

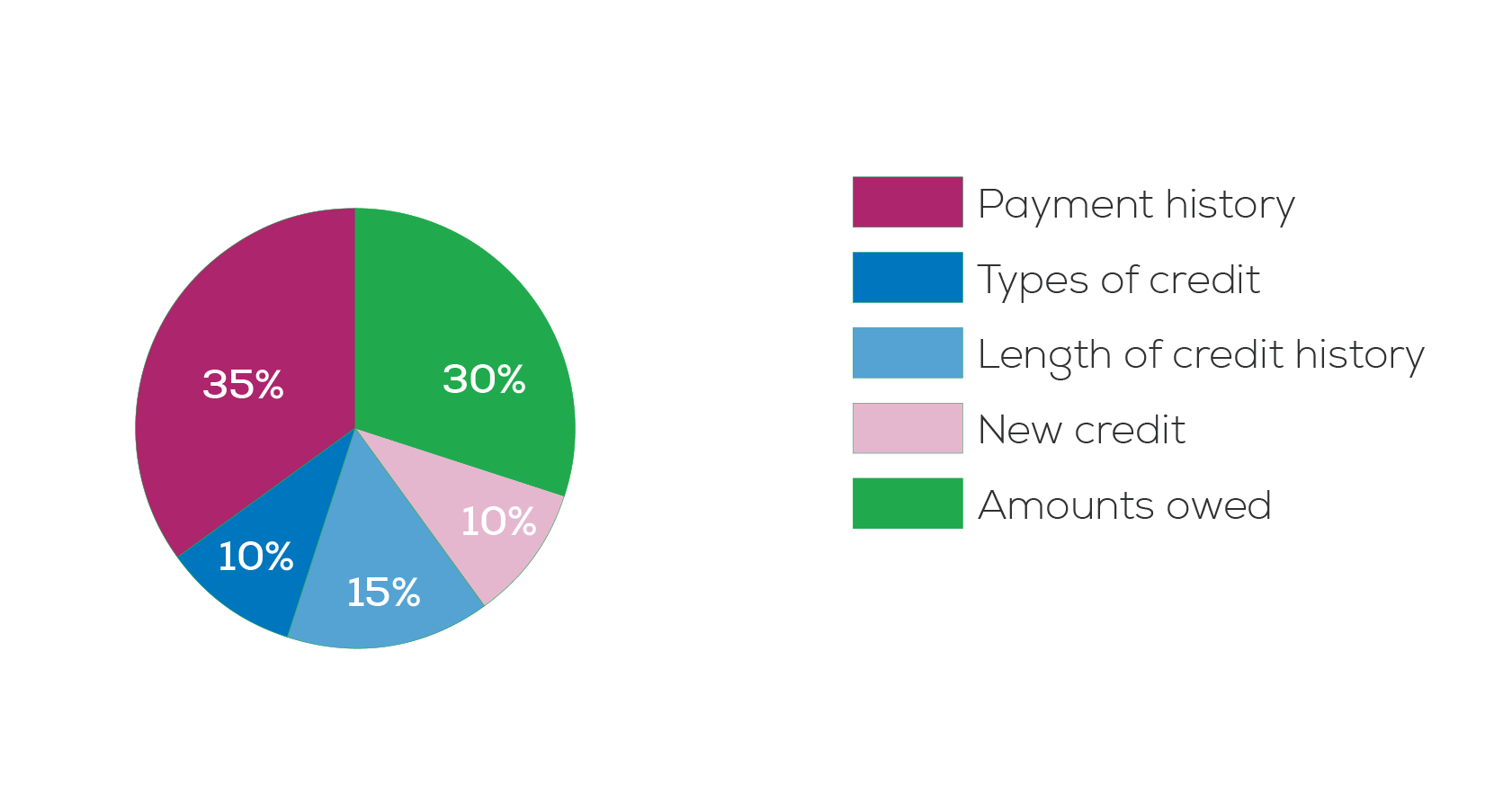

Investopedia lists five factors that determine a person’s FICO credit score and their percentage of influence:

- Payment History

- Total Debt Owed

- Credit History Length

- Types of Credit

- New Credit

Payment History (35%):

The largest determining factor is whether you’ve paid your prior debt obligations on time and in the full amount. To avoid a ding to your credit score, pay close attention to the various amounts owed and their due dates. Missing a payment will lower your credit score and cause you to pay more interest.

Consider listing the amounts owed on certain days in your calendar, either physical or electronic, to act as a visual reminder. NerdWallet.com recommends to pay your credit bills in advance if possible to avoid large amounts of interest owed down the line and improve your credit rating.

Pay your required minimum payment each month and your lenders will be satisfied. Although, you’ll still be charged interest on the remaining amount owed. If possible, pay your balance in full to avoid paying any interest at all!

Total Debt Owed (30%):

The second factor is the amount of credit you have open (loans, mortgage, credit cards, etc.) and how much you owe in total. When it comes to credit cards, there’s no magic number for how many you should have. For most people, managing expenses and keeping track of what’s owed is easier with only 1 ‒ 3 cards, which leads to more mindful spending.

However, if you are a debt-managing confidant, you can increase the amount of credit cards you use. Paying off multiple credit card balances is a great way to raise your credit score. It shows financial institutions you can manage several lines of credit and still make the payments. But be wary of opening too many cards. Too many credit inquiries in a short timeframe and falling behind on payments can cause your credit score to plummet.

Credit History Length (15%):

This credit rating factor boils down to one simple thing: history of credit usage. Lenders will take positive notice if you can show a long credit history with little-to-no issues. If you don’t have any credit history, consider making the leap now so you can establish a credit score to use in the future.

To enhance your credit score, be sure to hold onto well-managed accounts that you’ve used frequently for a long time. For high-interest accounts you’ve had for a short term, pay the balance in full every month and use them sparingly.

The general rule of thumb is to only use credit for what you need, anything more is subject to cause financial strain and problems down the line. Avoid buying things with credit that don’t appreciate such as clothes, groceries, vacations, etc., unless you pay the balance in full.

Types of Credit (10%):

This factor’s percent of influence may be small when compared to those above, but if you want to achieve the perfect 850 credit score, it’s still important to consider. Essentially, the more diverse the types of credit you have, the more confident a lender will be when giving you credit. This is especially true if you can prove that you’ve had experience paying off the same type of loan or credit you’re currently applying for.

However, building up an arsenal of different types of loans is more of a suggestion than a requirement when looking to advance your credit score. But don’t let that deter you from exploring the many different types of credit loans available.

According to FICO, data shows that lenders perceive borrowers with a good mix of installment loans and revolving credit to be less risky than those with limited-to-no- credit or loan experience.

New Credit (10%):

The final factor is based upon how much new credit you’ve received or applied for recently. FICO’s research shows that “opening several new credit accounts in a short period represents greater risk - especially for people who don't have a long credit history.” Lenders may perceive you to be struggling financially if you’re applying for substantial amounts of credit at many places within a short time.

The good news is applying for new loans rarely drops your credit score immensely. If it does drop, it’s usually only by a few points. Just don’t go overboard with opening several new accounts within a six-month timespan to be safe.

As you can see, credit scores are much more than just a three-digit number. They represent how trustworthy someone is with paying off debt by evaluating a multitude of factors. By understanding these pieces of the credit score puzzle and how to perform well by them, you’ll find you’re approved for more loans with larger balances and lower interest rates!

With practice and dedication over time, your credit score will increase. Happy borrowing!

Looking for a credit card with no annual fee, local servicing, fraud protection and convenient online access? See what credit card options exist for you at IHMVCU!